Tata Technologies IPO Details, Peer Comparison and Important Dates

Tata Technologies, a subsidiary of the renowned Tata Group, is a global engineering and product development company with a proven track record of innovation and success. The company provides a comprehensive suite of services to clients across various industries, including automotive, aerospace, and healthcare. Its expertise in engineering design, manufacturing processes, and product development has earned it a reputation as a trusted partner for global corporations.

The much awaited Tata Technologies IPO is announced and in this i am going to discuss about the company. Such as it's key financials, risks, etc. Let's start.

Primary Business of The Company:

It is a Engineering services company offering product development and digital solutions, including turnkey

solutions, to global OEMs and their Tier 1 suppliers globally (Source: Zinnov Report).

the company working in automotive, aerospace and transportation and construction heavy machinery (“TCHM”) industries.

Industry in which The Company Operates:

The Company Operates in the global engineering, research and development (“ER&D”) services industry, primarily across automotive, aerospace and TCHM verticals. The global ER&D spend for 2022 was approximately $1.81 trillion and is expected to grow to approximately $2.67 trillion by 2026. The ER&D spend outsourced to third party service providers reached $105-$110 billion in 2022 and is anticipated to grow at a 11-13% CAGR between 2022 and 2026. The key growth drivers within the ER&D market include an increasing propensity to outsource, increasing regulatory interventions for safer and cleaner products, shrinking product innovation cycles and next-generation product technologies (source: Zinnov Report).

Based on above key insights we can understand the there is good opportunity in this industry.

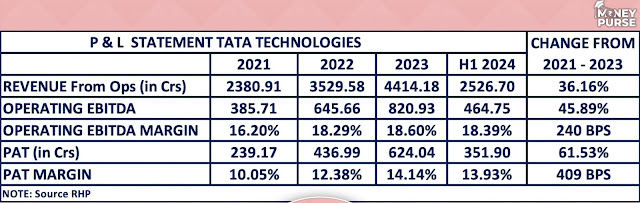

COMPANY FINANCIALS:

Based on the RHP of the company in SEBI portal, bellow are some key financial indicators.

Revenue from operations from clients in India, Europe, North America and rest of the world 🌎.

Key Ratios:

Some Risk Factors:

1. This IPO is completely offer for sale. Existing Promoters selling some portion of their stake. Company will not get money from this IPO.

2. High client concentration. More than 50% of the revenue coming from the top 5 clients. If anyone or all of the clients business deteriorates it will directly impacts this company's revenue.

3. Since the company Operates engineering R&D with automotive, aerospace and TCHM industry. The company Earning more than 80% revenue from automotive segment. The automotive industry is an cyclicality business nature. If an economy slowdown or any other factors impacts the automotive segment downturns it will directly impacts the company revenues.

4. Some of the same group companies such as Tata Elxsi, TCS Ltd are operate in a similar lineof business, which may lead to competition with these entities and could potentially result in a loss of business opportunity to this Company.

IPO Details and Important Dates:

Disclaimer:

This blog post is for Educational and informational purposes only and should not be considered investment advice. Please consult with a financial advisor before making any investment decisions.

Comments

Post a Comment